In an era where information is readily accessible, the art of trading is evolving at a breathtaking pace. Enter simulated trading—a revolutionary tool that is reshaping how beginners embark on their financial journeys.

No longer do aspiring traders find themselves in the intimidating world of charts and candlesticks without guidance. Instead, they can immerse themselves in a risk-free environment, where the tension of real financial stakes is replaced by the excitement of learning through experience.

This innovative approach not only demystifies the complexities of the market but also instills confidence in those just starting out. With interactive platforms offering realistic trading scenarios, novices can now experiment, strategize, and make mistakes—all without the fear of financial loss.

As we delve deeper into this transformative shift, well explore how simulated trading is not merely an educational tool but a vital stepping stone that empowers beginners to navigate the intricate world of trading with newfound expertise.

What is Simulated Trading?

Risk-Free Learning Environment

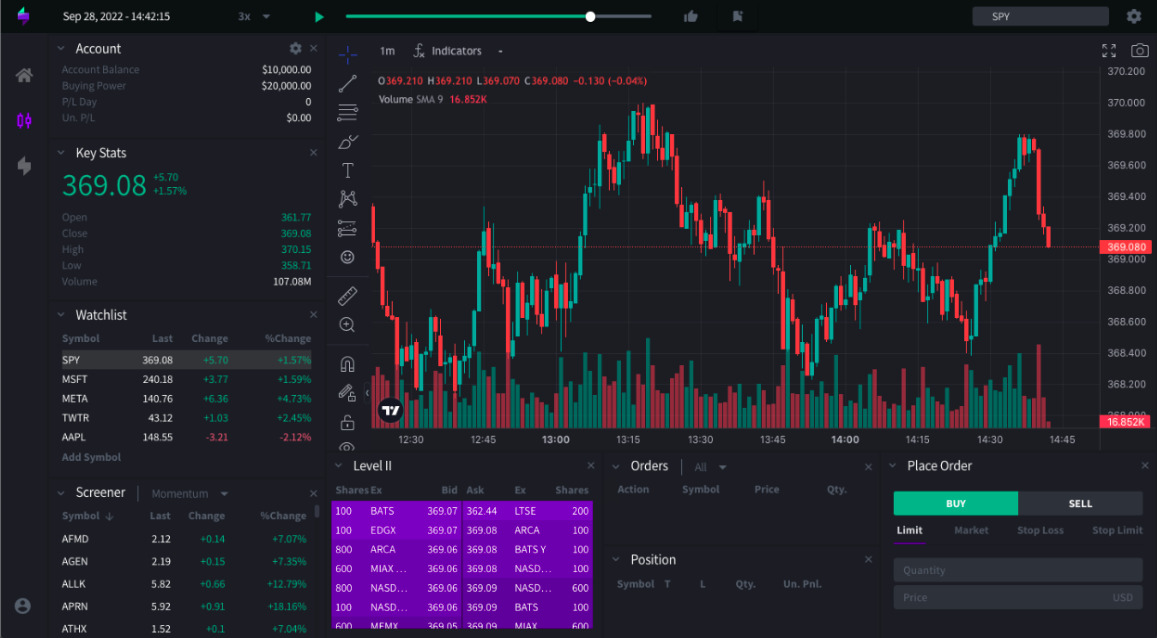

In the realm of trading, the fear of loss can be paralyzing, especially for beginners venturing into the complexities of financial markets. Simulated trading provides an invaluable risk-free learning environment where aspiring traders can navigate the turbulent waters of buying and selling without the looming specter of real financial loss. Imagine this: a vibrant digital platform mimicking real-world market conditions, where each click can yield a profit or a loss, yet the stakes are merely an illusion.

Here, beginners can experiment boldly, testing strategies, exploring diverse asset classes, and analyzing market reactions, all while honing their decision-making skills. This sandbox approach not only cultivates confidence but also fosters a deep understanding of market mechanics.

As learners engage in this virtual trading arena, they develop an innate resilience, preparing them for the unpredictable nature of actual trading scenarios. In essence, simulated trading transforms apprehensive novices into self-assured participants, ready to tackle the challenges of the market with experience and insight to back them up.

Understanding Market Dynamics

Understanding market dynamics is crucial for anyone stepping into the world of trading. These dynamics are influenced by a multitude of factors ranging from economic indicators to global events, and they can shift rapidly, creating opportunities as well as risks.

Picture this: a sudden geopolitical crisis can send stocks tumbling, while a robust jobs report might spark a rally. For beginners, grasping these intricate patterns and the forces at play can feel like navigating a labyrinth.

However, simulated trading provides a unique lens through which aspiring traders can observe these dynamics in real time. By experimenting with different strategies without financial risk, learners can witness firsthand how market conditions affect their trades.

This immersive experience fosters a deeper understanding that theory alone cannot offer, effectively preparing them for the unpredictable nature of actual trading environments.

Conclusion

In conclusion, simulated trading is revolutionizing the way beginners learn to navigate the complex world of trading. By allowing novices to experiment with real-time strategies in a risk-free environment, simulated trading builds confidence and enhances understanding of market dynamics. The incorporation of tools such as replay charts further enriches these learning experiences, enabling users to revisit past market conditions and refine their strategies.

As technology continues to evolve, the accessibility and realism of simulated trading will undoubtedly empower a new generation of traders, preparing them for success in the competitive trading landscape.